As we approach the year-end, there is no better time than now to compile your checklist of tax saving strategies to reduce your income tax bill for 2019.

-

- Reduce tax on shareholder draws

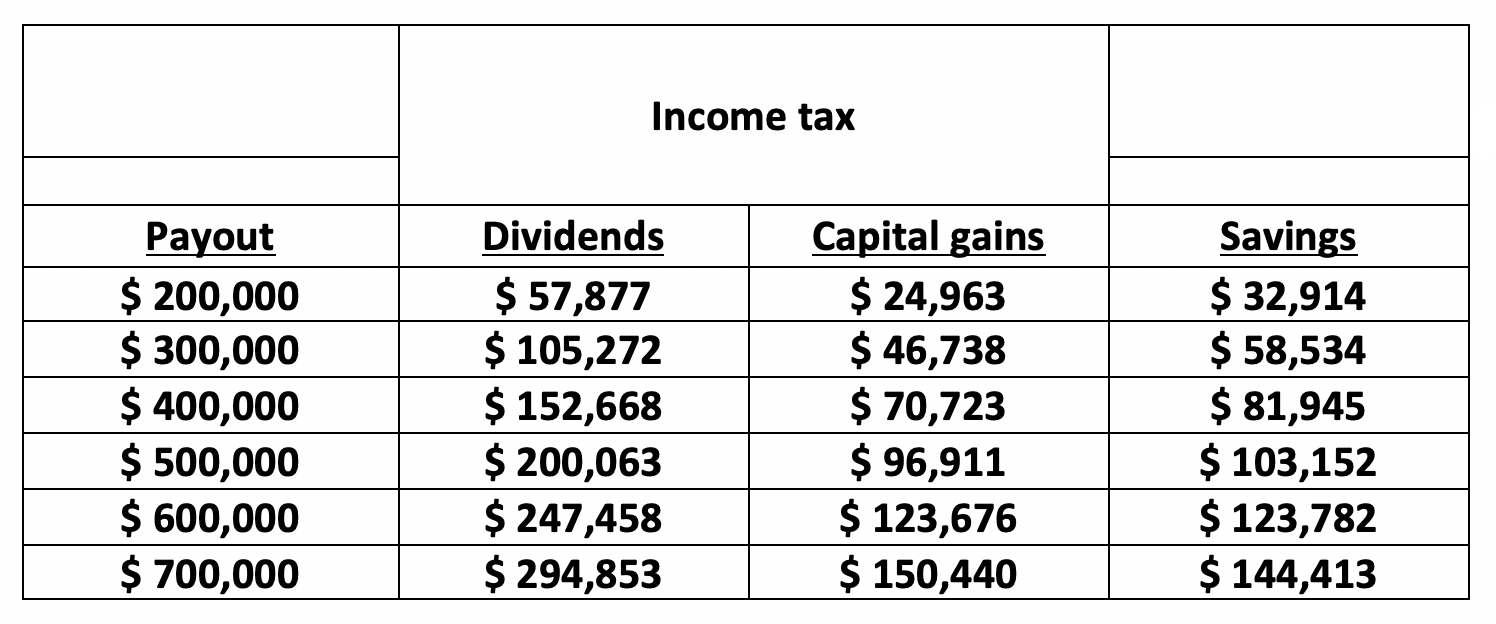

If you took large draws from your corporation, which would normally be reported as dividends on your tax return, consider converting those dividends to capital gains. The Table illustrates the tax savings.

- Reduce tax on shareholder draws

- Pay salaries to family members

The new income splitting restrictions eliminate the benefits of allocating income to family members in lower tax brackets. As your PJ&A trusted advisor, we work with you to determine the best remuneration strategy. It is interesting that the new restrictions do not apply to salaries paid for actual work performed. However, salaries paid to family members must be reasonable. A good test of reasonableness is to pay them what you would have paid to a third party. An individual can earn up to $12,069 and pay no federal tax.

- Pay tax-free dividends if you can

You may be able to make tax-free withdrawals from your corporation by paying yourself capital dividends. Capital dividends are available, if your corporation has a balance in its capital dividend account (CDA). The CDA balance is increased by the non-taxable portion of capital gains and reduced by the non-deductible portion of capital losses.

- Triggering gains or losses

Check with your PJ&A advisor to find out if there is a benefit to selling investments with accrued losses to offset capital gains. Any net capital loss that cannot be used in the current year can be carried as far as three years back or carried forward indefinitely to offset net capital gains in other years. Depending on your unique tax situation, there often is a benefit to triggering capital gains this year.

- Make expenditures before year-end

If you are planning to purchase capital assets in the near future, consider purchasing these assets prior to the end of your corporate year-end. This will allow you to claim the capital cost allowance, or CCA, for 2019.

If you are planning to sell capital assets, you might want to delay the sale until after the year-end so that you can get the benefit of one additional year of CCA. - Make loans to split investment income

If you are in a high tax bracket, you can arrange to shift investment income to family members in a lower tax bracket. To do this, you simply lend funds to family members provided the rate of interest on the loan is at least equal to the CRA-prescribed rate, which currently is 2 per cent until Dec. 31, 2019. If you implement the loan arrangement this year, the 2 per cent interest rate is locked in and will remain so for the duration of the loan. The income is taxed at the family member’s tax rate and the interest on the loan for each calendar year must be paid annually by Jan. 30 of the following year. The interest is deductible against the investment income of the family member.

- Contribute to an RESP

Take the edge off the high cost of post-secondary education by contributing to a RESP before the end of the calendar year. A contribution of $2,500 will generate the maximum annual education savings grant of $500, or 20 per cent of the contribution. The lifetime maximum savings grant per child is $7,200.