The Canada Emergency Rent Subsidy (CERS) was just announced, and it will replace the Canada Emergency Commercial Rent Assistance (CECRA) program.

The CERS will be similar to the CECRA, as it will provide rent relief for small businesses and professional practices. Still, the new version is much better since it allows you to bypass the landlord to get direct relief. The new benefit will be retroactive to September 27, 2020.

The CERS will cover up to 65% of rent or mortgage interest payments or if your practice has seen a decline in revenue by at least 70%. Even if your practice revenue has declined by less than 70%, you may still qualify for a decreased version of the CERS. If your practice is forced to shut down to mandatory orders temporarily, then you could get funding up to 90% of your rent or mortgage interest payments. The CERS can provide lots of benefits to you, so you have to ensure that you know how to apply for the program and how much CERS pays.

CERS eligibility,

To qualify for the Canada Emergency Rent Subsidy, you need to meet the following conditions:

- You have a CRA business number on September 27, 2020, OR

- you had a payroll account of March 15, 2020, or using a payroll service provider, and have a CRA business number, OR

- you purchased the practice- or business assets of another person or partnership who meets the above conditions,

- you are an eligible business, charity, or non-profit

- you experienced a drop in revenue during the claim period compared to a previous period ( no minimum).

- You rent or own a property that is used by your business or practice in Canada. Personal residences and rental income properties are not eligible.

- You have eligible expenses.

As a renter, these are the expenses you can claim:

- Rent

- operating expenses such as insurance, utilities, common area maintenance etc.

- property taxes

- parking fees etc.

As a landlord, you can claim the following expenses:

- Property and similar taxes

- property insurance,

- mortgage interest.

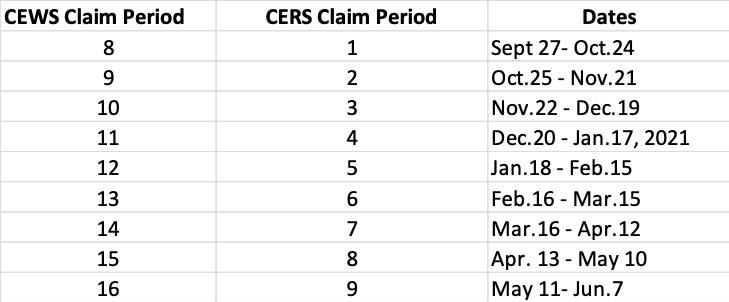

CERS Claim Periods

CRA will begin processing claims on November 30, 2020.

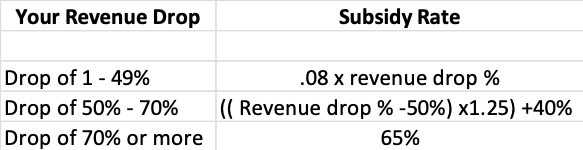

Calculating your subsidy amount

The subsidy has two parts: the base amount and the lockdown support amount.

Similar to CEWS, to calculate your drop in revenues, you compare revenue year over year using the corresponding month in the previous year, or the alternative method of comparing revenue to your revenue in January and February 2020.

Lockdown support top-up

The lockdown support top-up is available should your business or practice be ordered to close certain activities by a public-health order. If your practice is affected by at least one week, you may receive additional support of up to 25% of eligible expenses. This applies to each location that is impacted.

The lockdown top-up is calculated as follows:

Top-up = 25% X No. of days location was closed/28 days in the CERS period.

How do you apply?

Applications are processed directly through the CRA using the My Business Account portal. You will be required to set up a CERS number before you apply through your account.

You must apply separately for each claim period.

Claims must be submitted within 180 days of the end of the claim period.

Canada Emergency Wage Subsidy (CEWS)

What the changes are

The CEWS has been extended to June 2021, including changes to the rates and top-up calculation.

Changes to CEWS as of November 19, 2020 (Bill C-9):

- the subsidy is extended to June 2021

- the maximum subsidy rate for periods 8 to 10 will remain at 65% (40% base rate + 25% top-up)

- beginning in period 8, the top-up rate and base rate are is now calculated using the same one-month revenue drop

- for periods 8 to 10, use the new top-up calculation or the previous 3-month average drop, whichever works in your favour

- the deadline to apply is January 31, 2021, or 180 days after the end of the claim period, whichever comes later

starting in period 9, the calculation for employees on leave with pay now aligns better with EI benefits