The year 2020 was a time that everyone wants to forget. The pandemic disrupted our lives in unimaginable ways. It brought our economy to its knees, forcing the closure of many thriving businesses. Medical clinics were not spared either.

The disruption in income had a lot of doctors worried about how to pay the bills. Many of them did not have the cash reserves and had to resort to a line of credit to pay for ongoing clinic costs and personal living expenses.

There was a collective sigh of relief when revenues eventually recovered to pre-COVID levels.

To get the economy back on its feet, the Bank of Canada used their monetary tools to lower the bank rate to currently one-half percent. This created a significant drop in the yield of interest-bearing securities. You are lucky if you can find a secure investment today for 2%. The government is not concerned about the inflation rate which is 2%. Hence, you can expect this low rate investment climate to continue for a few years.

Here is an illustration on how the lower yields on your investments will impact your ability to save.

If you invest $4,000 per month for 20 years at 6%, you will have accumulated almost $1.9 million in your portfolio.

On the other hand, if the yield drops to 2%, your investment will shrink by $400,000 to $1.2 million. A drop of $700,000!

The sharp decline in the interest rate particularly affects those nearing retirement.

Consider the situation of Dean and Cheryl. Dean retired from his medical practice this year when he turned 65. Many years ago, they set a goal to have an annual investment income of $80,000 for the next 30 years. Their advisor suggested a 4% investment withdrawal rate, which meant an investment target of $2 million.

The 4% withdrawal rate for investments has been the gold standard for many years. Previously, the 4% withdrawal rate was always considered very conservative. It assumed a risk-averse couple at age 65, with limited stock market exposure in a portfolio, were able to provide funding for 30 years of retirement.

This all changed with the pandemic.

Having reached the investment goal of $2 million, Dean and Cheryl counted on receiving $80,000 per year for the rest of their lives. It came as a shock to them when their financial planner cautioned them to withdraw only 3% annually from their investments. With the majority of their portfolio invested conservatively at 2% currently, there is a likelihood that with the 4% withdrawal rate they would run out of funds during their lifetime. It was a bitter pill to swallow dropping their expected income of $80,000 to $60,000.

While the $60,000 per year would take care of their basic needs, it does not allow for much else.

One solution Dean and Cheryl should consider is to access the equity of their home to supplement their retirement income. By arranging for a Home Equity Line of Credit (HELOC), they can enjoy a fun retirement without ever having to worry about money. The dream of taking the Oceania cruise on the Baltic Sea is high up on their bucket list.

The HELOC accomplishes the best of two worlds: tax-free income and continued enjoyment of their present home. There is no need to downsize to take the equity out of your home.

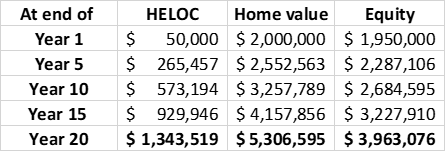

Suppose Dean and Cheryl own their home mortgage-free worth $2 million. It is expected to appreciate by 5% annually. They arrange for a HELOC at 3%, with interest accumulating on the line of credit. Suppose they want to draw $50,000 per year for the next 20 years. The table shows the impact of their draws on the equity remaining in their home.

To illustrate, in 10 years they have drawn $500,000 plus the interest owing, for a total of $573,194. The value of their $2 million home increased to $3,257,789 in Year 10. Their equity in the house would be $2,684,595. Despite taking $500,000 of draws, the home value still increased by $685,000.

The home line of credit is a fantastic tool that lets you enjoy your retirement years to the fullest without worrying about the pandemic and its effect on your investment portfolio.