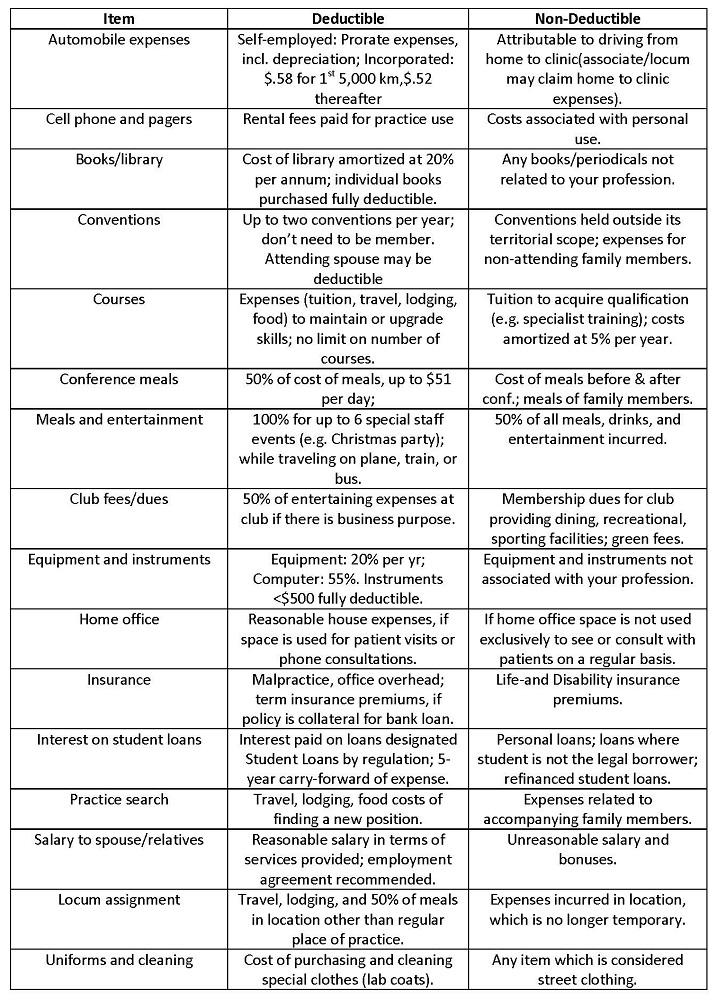

Meals and Entertainment

- Maximum amount that can be claimed is 50% of the actual cost of food, beverages and entertainment and incurred.

- The 50% limit also applies to gift certificates for food and beverages and tickets to sporting events and concerts purchased for patients or staff.

- 100% of expenses can be claimed if the event is available to all staff members. The employer is limited to six events per year.

- Meals and beverages served (and entertainment provided) while traveling on an airplane, train or bus are not subject to the 50% limitation if the cost is included in the travel fee. Food and beverages provided while traveling by boat or ferry are subject to the 50% limitation.

Club Fees and Dues

- Green fees or membership fees in a golf club are not deductible. There is an exception for expenses incurred for food and beverages at a restaurant, conference room, etc. of a golf club if they are incurred for genuine business purposes and the expenses are not incurred in conjunction with a game of golf or other recreational activity at the club. Such amounts are subject to the 50% meals and entertainment limit discussed above.

Home Office

- You can deduct expenses for the business use of a work space in your home, as long as you meet one of these conditions:

- it is your principal place of business; or

- you use the space only to earn your business income, and you use it on a regular and ongoing basis to meet your clients, customers, or patients.

- You can deduct a part of your maintenance costs such as heating, home insurance, electricity, and cleaning materials. You can also deduct a part of your property taxes, mortgage interest, and capital cost allowance. To calculate the part you can deduct (area used for business purposes only), use a reasonable basis such as the area of the work space divided by the total area of your home.

Interest on Student Loans

- Interest is deductible on loans received under

- the Canada Student Loans Act;

- the Canada Student Financial Assistance Act; or

- a similar provincial or territorial government laws for post-secondary education.

- Interest is not deductible on

- a personal loan or a line of credit;

- a student loan that has been combined with another kind of loan; or

- a student loan received from another country.

- Undeducted amounts may be carried forward five years.

Uniforms and cleaning

- Cost of purchasing and cleaning special clothing, designed for protection from the particular hazards of the occupation, are fully deductible.

- The cost of suits or other street clothing that can be used for both business and personal activities is considered to be a non-deductible personal or living expense by the CRA.

Practice search

- Cost of travel, lodging, and food associated with researching the new position or practice location are deductible.

- Costs incurred for family members are non-deductible.

Locum assignment

- You can deduct travel expenses you incur to earn professional income. Travel expenses include:

-

- public transportation fares;

- hotel accommodations; and

- meals, however, the 50% limit applies to the cost of meals, beverages, and entertainment when you travel.

- Costs incurred for family members are non-deductible