Not having an updated will One of the biggest mistakes in planning for your heirs is not to have an estate plan at all. If you do not have an updated will, you are not alone. According to a survey by BC Notaries, only 55 per cent of BC residents … [Read more...]

Just for Doctors Newsletters

Don’t let the CRA Grinch ruin your Christmas party

Before you uncork the Dom Perignon champagne to celebrate another successful year with your employees, you need to check the rules regarding taxable employment benefits for staff. Basically, CRA’s position is: “If you provide a free party or other … [Read more...]

Year-end tax planning checklist

There are only three weeks left until Dec. 31, and there is no better time than now to compile your annual checklist of tax saving strategies, designed to reduce your income tax bill for 2018. Convert dividends to capital gains. If you took … [Read more...]

Want to boost your portfolio returns? Don’t tinker with it!

If you are in the habit of checking your investment portfolio daily, you should find yourself a new hobby. Stop tinkering and your investment portfolio will grow that much faster. This conclusion was the result of a 10-year study of mutual fund … [Read more...]

‘Pensionize’ your Corporate Savings

As you squirrel away your excess cash in a corporate investment account, you eventually face the question of how to convert your savings into retirement income. If you are seeking a sustainable, life-long retirement income, look no further than … [Read more...]

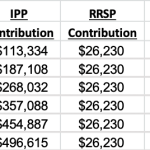

How Corporate Tax deferral can help you retire seven years earlier

If your corporation’s income is taxed at a low tax rate of say 12 per cent, it means $88 out of every $100 of practice income is retained in the corporation. The tax deferral benefit will have a huge impact on your retirement savings. Suppose … [Read more...]

Cutting your taxes in half

No longer able to sprinkle company dividends among family members in the low tax bracket, many doctors are bracing themselves for a big hike in personal taxes on their dividend income from their corporations. There is a tax strategy that lets … [Read more...]

Income splitting tips for 2018

Doctors are braced for a steep hike in personal taxes this year when they are no longer able to split income with family members the way they used to. On January 1, 2018, the “tax on split income” (TOSI) rules became effective. This severely … [Read more...]

Habits to Help Achieve Financial Success

Plan before you act. As a doctor, you are equipped with the skills you need to give your patients the best treatment. But stellar medical treatment alone, does not guarantee financial success. For that, you need a vision of how to achieve both … [Read more...]